Private Equity Real Estate Firm Managing Multifamily Properties in the Houston MSA

Heritage Investments is a private equity real estate firm that was established with the sole vision of a secure equity investment growth vehicle through value-add multifamily properties in Houston MSA.

Click the “Invest with Us” button to learn about our new investments and never miss a new opportunity.

Achieve Multi-Generational Wealth Through

Houston MSA Multifamily

Real Estate Investment

Our Goals

Structure “investor-friendly” deals to grow Multi-Generational Wealth while protecting our investors’ capital that builds legacy for you and your family.

Enable our Investors to achieve Financial Freedom through Passive Real Estate Syndication (group to pool equity) Investments.

Improve the quality of life of residents through property improvements, excellent service and community events.

Build safe and affordable communities that attract sticky, long-term residents to maximize retention and minimize turnover.

Our Acquisition Criteria

We strive to find the best multifamily deals in the Greater Houston market with conservative underwriting, low investment risk and high value-add potential, which preserves your capital while maximizing its growth. Using our local knowledge and resources, we locate, acquire, improve, manage, cash flow, and ultimately sell the property to maximize the “Alpha” returns for our investors.

Our Strategy

The foundation of Heritage Investments is our uncompromised ethics, honesty and integrity. We truly value our investor’s trust as stewards of their capital. Our objective is to grow wealth together with our investors and multifamily partners.

Locate and Acquire the Property

- Strategic acquisitions with deep focus on Houston sub-markets that have population and jobs historically trending up. We analyze market reports from specialty apartment firms and look for employment diversity.

- We identify an underperforming asset with net positive cashflow from Day 1. We conservatively underwrite deals and select properties with good cashflow and huge appreciation potential with below market rents, ineffective property management, deferred maintenance, economic vacancies, etc.

- We perform exhaustive and careful due diligence (inspections, financial audits, etc.) of that property and its comps. Thereafter, we create a comprehensive business plan for the property.

- Using our strong relationships with lenders, we create the deal structure after evaluating various financing options: Traditional Financing, Agency Debt and Bridge Loans.

Add Value & Reposition the Property

- Working with our seasoned third party professional property managers, we make interior/exterior improvements, rebrand (if needed) and upgrade and/or add amenities like BBQ grills, Cabanas, Dog parks, Washer Dryer, Reserved Parking, etc.

- Using economies of scale in renovation construction, we upgrade interior finishes in the units including appliance packages, flooring, fixtures and paint all of which allows us to increase rents to market which immediately increases the value of the asset.

- Through implementation of value-add strategies, we reposition our residents, increase economic occupancy and achieve parity with market rents.

Create Tax Benefits for our Investors

- We perform a cost segregation study to accelerate the depreciation to maximize initial tax benefits of ownership.

- We incorporate bonus depreciation wherever possible.

Generate "Alpha" to return Maximum Invested Capital

By improving the net operating income (NOI) through our diligent efforts, and thereby increasing the value of the asset, we refinance or sell the property to return most or all of the investors’ capital.

Meticulous Asset Management and "Investor First" Communication

- We execute ‘hands-on’ asset management in collaboration with our third-party property managers to apply best practices and fine-tune the operations to run at maximum efficiency.

- Our investors receive regular performance updates and monthly/quarterly distributions of the cash flow.

Sale of the Asset

We maximize returns to the investors by judiciously monitoring the national and local markets to determine the best time to sell the asset.

Holistic Investment Management

As responsible stewards of capital, we utilize a comprehensive approach to every facet of the investment lifecycle to mitigate the risks and protect investor capital entrusted to our firm.

Benefits of Multifamily Investments

Benefits of Multifamily Investments

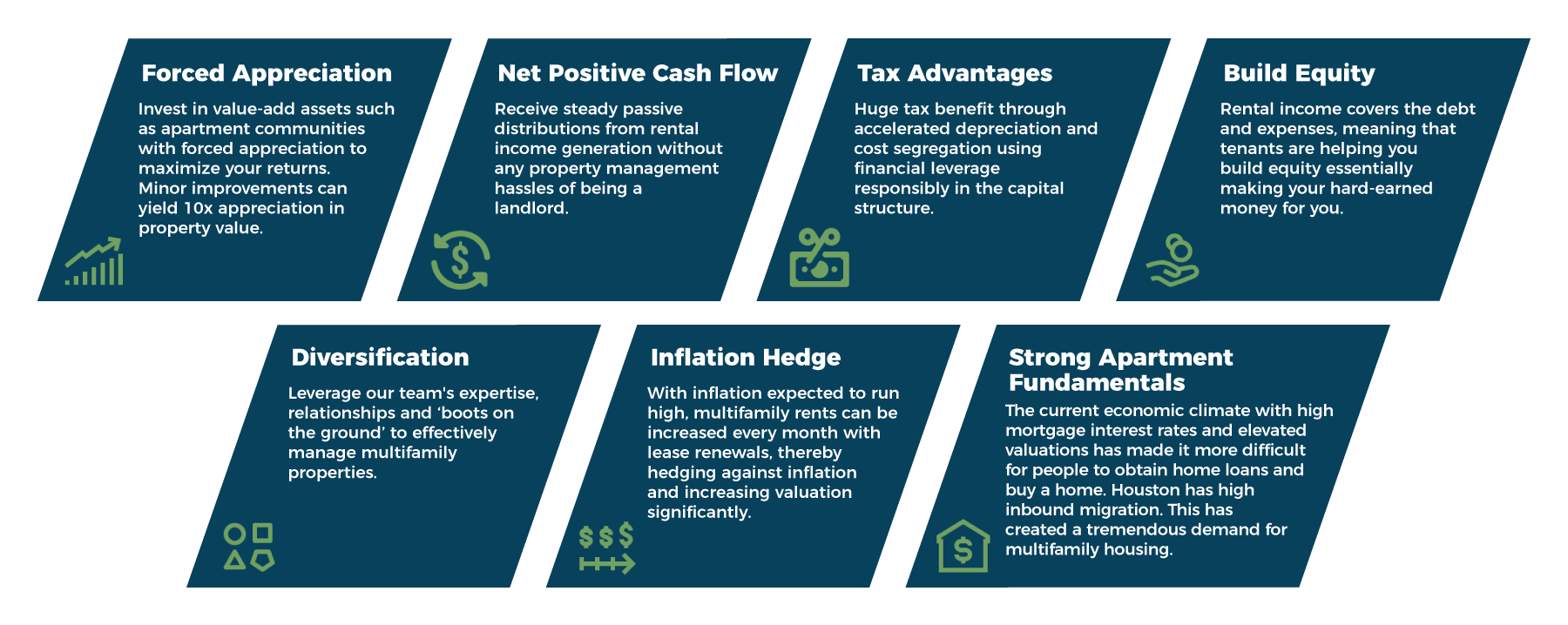

Forced Appreciation

Invest in value-add assets such as apartment communities with forced appreciation to maximize your returns. Minor improvements can yield 10x appreciation in property value.

Net Positive Cash Flow

Receive steady passive distributions from rental income generation without any property management hassles of being a landlord.

Build Equity

Rental income covers the debt and expenses, meaning that tenants are helping you build equity essentially making your hard-earned money for you.

Tax Advantages

Huge tax benefit through accelerated depreciation and cost segregation using financial leverage responsibly in the capital structure.

Diversification

Leverage our team’s expertise, relationships and ‘boots on the ground’ to effectively manage multifamily properties.

Inflation Hedge

With inflation expected to run high, multifamily rents can be increased every month with lease renewals, thereby hedging against inflation and increasing valuation significantly.

Strong Apartment Fundamentals

The current economic climate with high mortgage interest rates and elevated valuations has made it more difficult for people to obtain home loans and buy a home. Houston has high inbound migration. This has created a tremendous demand for multifamily housing.

Our Team

Amir Hirani

CEO & Founder

Deepti Mikkilineni

Asset Manager

Contact Us

Interested in learning about our current investment projects? We would love to discuss our opportunities with you! Simply reach out and we will follow up with you as soon as possible.